Into cost of acquisition during property sale

As of April 2023, a significant change in tax laws has clarified the treatment of housing loan interest deductions and their role in calculating the cost of acquisition for property sales. While home loan interest deductions have traditionally been capped at ₹2 lakh for self-occupied properties, the new amendment introduces key nuances that taxpayers, especially those with multiple properties or housing loans, need to understand.

What Has Changed?

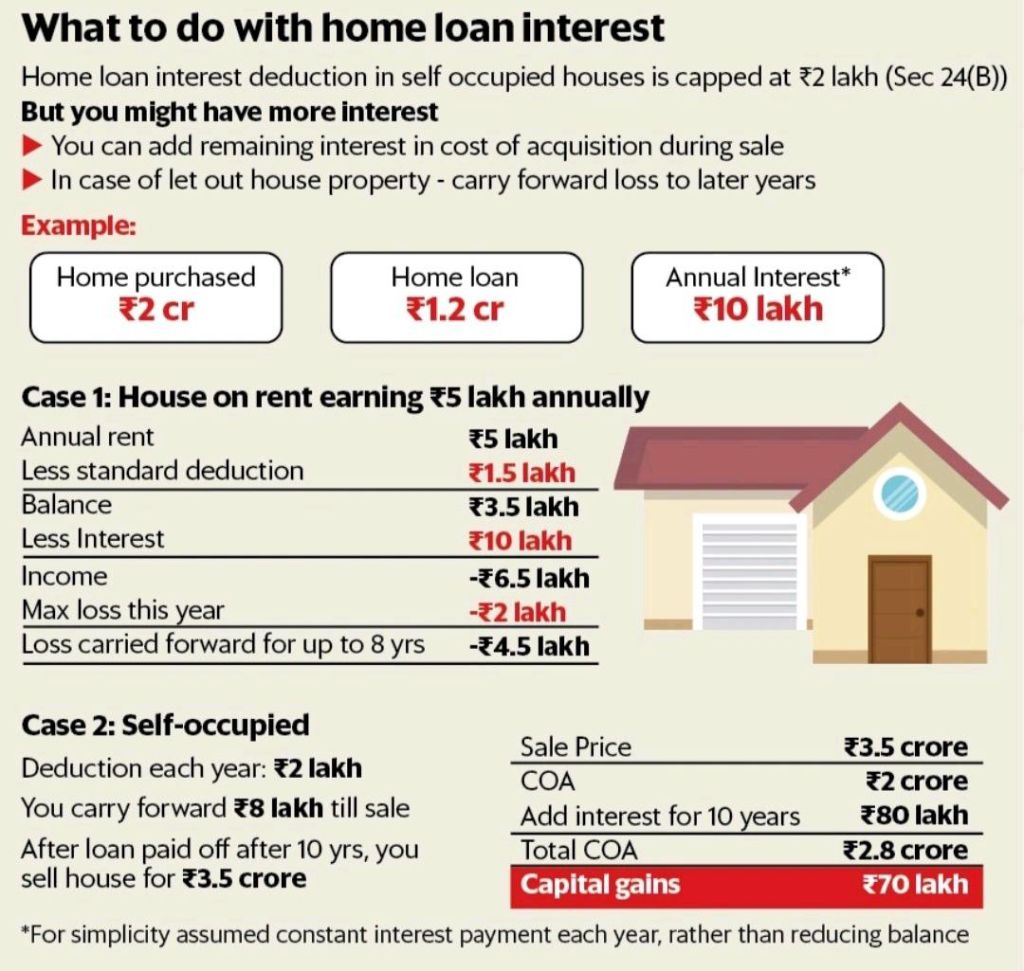

From April 2023, the law explicitly states that any interest claimed as a deduction under house property income cannot be included in the cost of acquisition of the property when calculating capital gains. This means that if you have already claimed deductions on the housing loan interest (either under sections 24(b), 80C, or 80EEA), you cannot add this claimed interest to the cost of acquisition for the purpose of reducing your capital gains tax during the sale of the property.

However, unclaimed housing loan interest can still be added to the cost of acquisition, which would help reduce the capital gains liability upon property sales. This provision applies regardless of whether you’re using the old or new tax regime.

Key Points to Note:

- Carrying Forward Unclaimed Interest: If you haven’t fully utilized the ₹2 lakh interest deduction limit in any year, you can carry forward the unclaimed portion to future years. This carry-forward benefit means that if you don’t claim the full deduction for any given year, the unclaimed interest can be deducted in subsequent years, up to the cap of ₹2 lakh per annum.

- Adding Unclaimed Interest to the Cost of Acquisition: Even though the claimed interest cannot be added to the cost of acquisition, the unclaimed interest can still be used to reduce capital gains when you sell the property. This provision holds true for both the old and new tax regimes. By adding this unclaimed interest to the property’s cost of acquisition, taxpayers can lower their capital gains, potentially reducing the tax liability significantly.

Impact on Capital Gains:

When you sell a property, the capital gains tax is calculated by subtracting the cost of acquisition (including any improvements or associated costs) from the selling price. Since the cost of acquisition directly impacts the amount of capital gains tax, increasing this cost by adding unclaimed housing loan interest will reduce the taxable capital gains, thus lowering your tax liability.

Example:

Let’s consider a hypothetical scenario:

This results in a lower capital gains and therefore a reduced tax liability.

How Does This Affect Both Tax Regimes?

Whether you are under the old tax regime or the new tax regime, the rules remain the same. Both regimes allow you to claim the unclaimed housing loan interest as part of the cost of acquisition.

- Old Regime: Taxpayers can continue to avail of various exemptions and deductions, including the unclaimed housing loan interest, which reduces capital gains.

- New Regime: While the new regime does not provide the benefit of most exemptions and deductions, it still allows taxpayers to adjust the cost of acquisition with the unclaimed interest to minimize capital gains tax.

Conclusion:

The 2023 amendment provides clarity on the treatment of housing loan interest and its effect on capital gains tax calculation. While claimed interest cannot be included in the cost of acquisition, the ability to carry forward and add unclaimed interest still offers taxpayers a valuable tool to reduce capital gains liability when selling property.

Taxpayers must be diligent in keeping track of their home loan interest payments and ensure they are aware of any unclaimed amounts that can be carried forward to future years or added to the cost of acquisition.

As always, it’s advisable to consult us to navigate these rules effectively and optimize your tax situation.

~Navneet Shukla

Leave a comment