If the aggregate value of monetary gift received during the year by an individual or HUF exceeds Rs. 50,000 and the gifts are not covered under the exceptions discussed below, then gifts whether received from India or abroad will be charged to tax.

Once the aggregate value of gifts received during the year exceeds Rs. 50,000 then all gifts are charged to tax

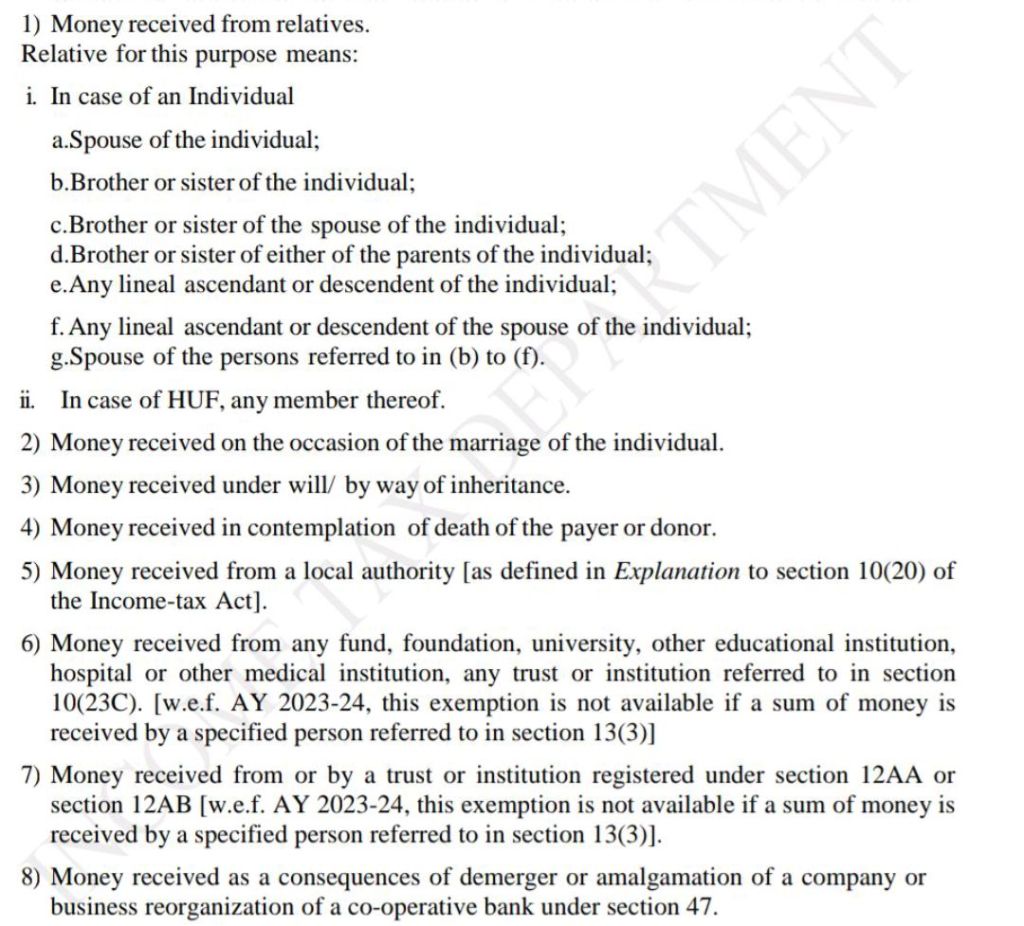

In the following cases, monetary gifts received by an individual or HUF will not be charged to tax.

~Navneet Shukla

Leave a comment