Limited Liability Partnership (LLP) is an upgraded form of Partnership, which has limited liability features of a Private Limited Company and the flexibility of a Partnership firm.

The maintenance cost of an LLP and simplicity in formation is one of the prime reasons it has become a preferred choice for company incorporation in India. Read to know about the process, documents required, and fees of LLP registration in Uttar Pradesh.

Table of Content

- What is LLP Registration?

- Checklist for LLP Registration

- LLP Registration Process

- Documents Required for LLP Registration

- LLP Registration Fees

- Documents Incorporation you’ll

What is LLP Registration?

LLP is a form of a partnership registered under the Limited Liability Partnership Act, 2008, where liabilities of all the partners are limited to the extent of contribution bought by them. It helps owners limit their liabilities while enjoying the advantages of a limited company which is an edge over a traditional partnership firm.

No partner is liable for unauthorized actions of other partners; thus, individual partners can safeguard them from joint liability arising from the misconduct of other partners. Professionals, micro and small businesses mostly prefer LLP as anorganization.

Minimum two partners are required to incorporate an LLP. However, there is no upper limit on the maximum number of partners of an LLP. There should be a minimum of two designated partners who shall be individuals, and at least one of them should be residents in India.

The LLP agreement governs the rights and duties of designated partners. They are directly responsible for complying with all the provisions of the LLP Act, 2008 and provisions specified in the LLP agreement.

Checklist for LLP Registration in Uttar Pradesh

- Minimum two partners

- At least one partner should be a resident of India

- Each partner has to contribute towards the capital of LLP

- Address proof of business

LLP Registration Process in Uttar Pradesh

The procedure of LLP registration in Uttar Pradesh is as follows:

- Reserve your LLP Name

- Obtain Digital Signature Certificate

- Application for LLP Registration

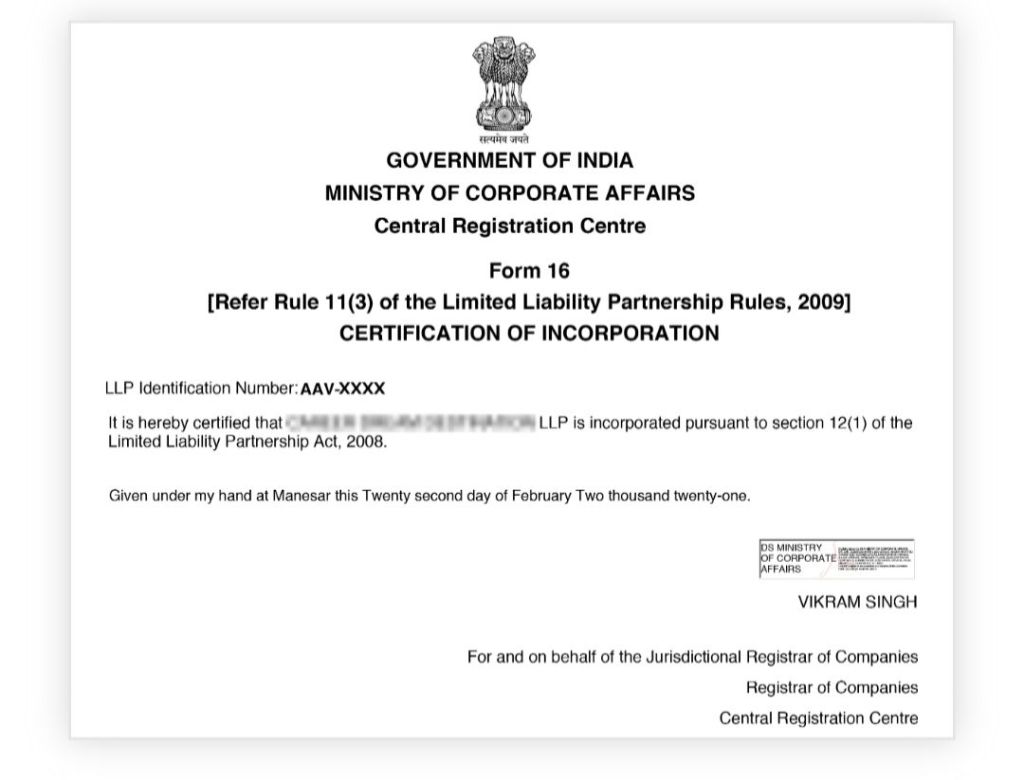

- Issuance of LLP Incorporation Certificate

- Drafting and Filing of LLP Agreement

Documents Required for LLP Registration in Uttar Pradesh

- Copy of Aadhar Card

- Copy of PAN Card of all partners

- Copy of Driving License or Voter ID

- Passport size photograph of all partners

- Bank Statement (not older than 2 months)

- Electricity or any other utility bill for office address proof

- No Objection Certificate from the owner of the property (if rented)

LLP Registration Fees in Uttar Pradesh

The total cost of LLP incorporation, including government and professional fees, is ₹24,499 Only. The LLP formation process takes around 10 working days subject to document verification by the Ministry of Corporate Affairs (MCA).

Total Cost ₹24,499 Only

DSC of 2 Partners

Govt Fee

Professional Fee

Documents you’ll get after LLP Registration in Uttar Pradesh

- Certificate of Incorporation

- Digital Signature Certificate (DSC)

- Designated Partner Identification Number (DPIN)

- LLP PAN

- LLP TAN

- Company Master Data

- LLP Agreement

- Company Name Approval

- Bank Account Opening Assistance

~Navneet Shukla

Leave a comment