- Short term gains of Equity at 20% tax rate (earlier 15%)

- Long term gains on all Equity at 12.5% (earlier 10%)

- Increase in limit of exemption of capital gains to *1.25 lakh per year (earlier ₹1.0 Lakh)

- Angel Tax abolished

- Standard Deduction increased to 75k (earlier 50k) for New Tax Regime

- Gold & Silver import duty decreased to 6% (from 15%)

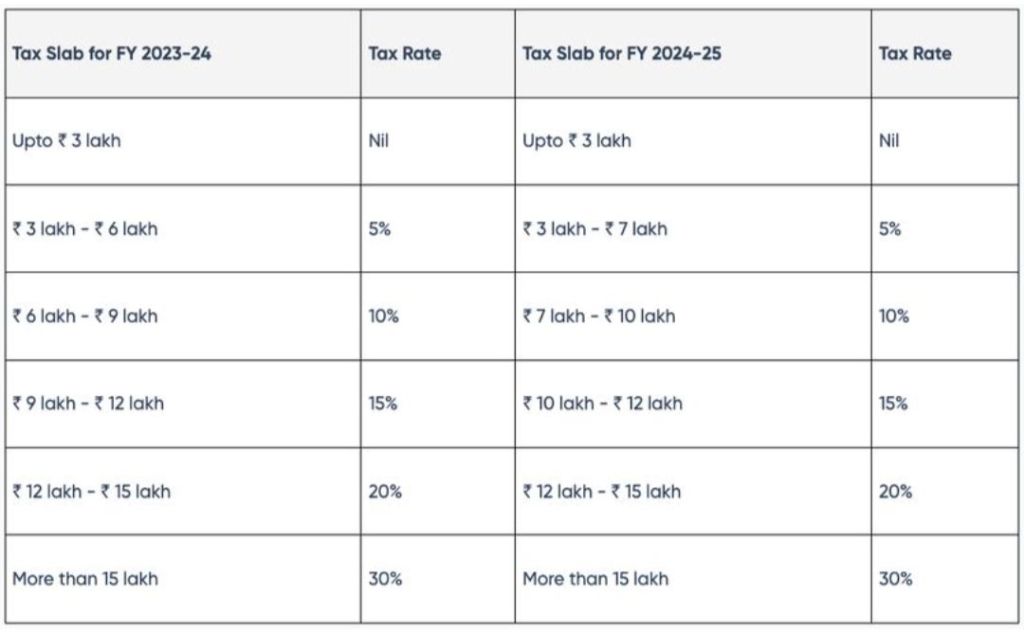

- Some benefits with Tax slab change under new tax regime as attached

- Indexation benefit removed from Real Estate. Long Term taxation at 12.5%, same as Equity. Holding period 2 years.

- FoF, Gold Funds and ETFs, International Funds will be tax after 2 years at 12.5% (not very clear)

~Navneet Shukla

Leave a comment