The Central Board of Direct Taxes (CBDT) via an order dated February 13, 2024, stated that the tax department has started remitting and extinguishing eligible old tax demands which were outstanding as of January 31, 2024.

“Consequent to the Order of the CBDT in 375/02/2023-IT-Budget dated 13.2.2024 eligible outstanding direct tax demands have been remitted and extinguished. Please log into your account and follow the path Pending Action Response to Outstanding Demand to check the status of ‘Extinguished Demands’ in your case,” said CBDT in the order dated February 13 2024, published on February 19, 2024

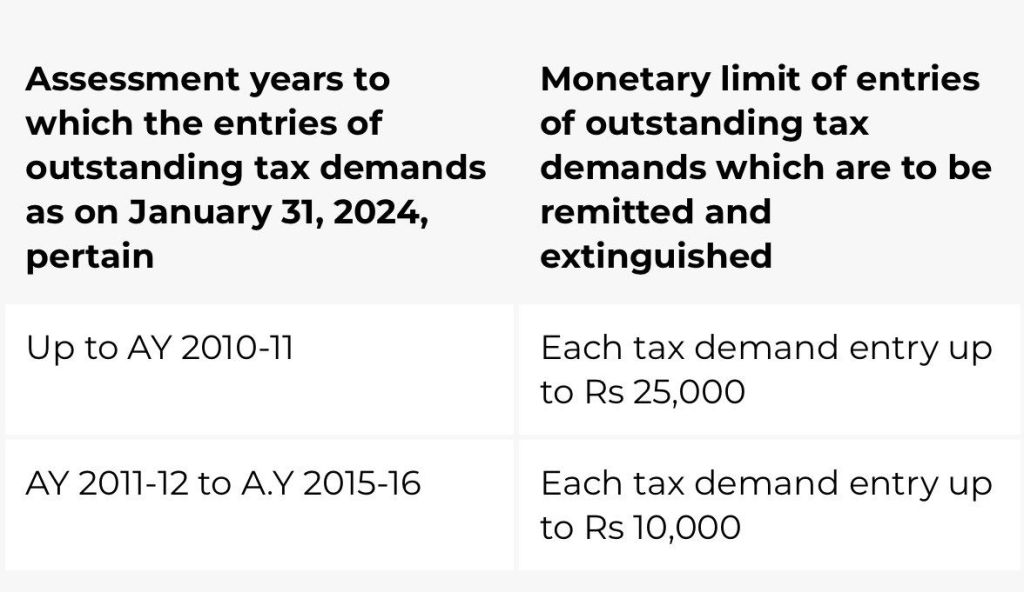

The remission and extinguishment of tax demand shall be subject to the maximum ceiling of Rs 1,00,000 (Rupees one lakh) for any specific taxpayer/assessee for the following types of demand entries:

a) Principal component of tax demand under the Income-tax Act, 1961 or corresponding provisions of Wealth-tax Act, 1957 or Gift-tax Act, 1958 and

b) interest, penalty, fee, cess, or surcharge under various provisions of the Income-tax Act, 1961, or corresponding provisions, if any, of the Wealth-tax Act, 1957, or Gift-tax Act, 1958.

The above remission and extinguishment of entries of outstanding direct tax demands shall not be applicable on the demands raised against the tax deductors or tax collectors under TDS or TCS provisions of the Income-tax Act. 1961.

Consequent to the aforesaid remission and extinguishment of entries of outstanding demand, there shall not be requirement of calculation of interest on account of delay in payment of demand under sub-section (2) of section 220 of the Income-tax Act, 1961 or corresponding provisions of Wealth-tax Act, 1957 and Gift-tax Act, 1958 and therefore, the same shall not be considered for the purpose of determining the ceiling of Rs. 1,00,000/- (Rupees one lakh).

If any tax liability arises against such a taxpayer/ assessee, as a result of application of sub-clause (xviii) of sub-section (24) of section 2 of the Income-tax Act, 1961, the same shall also be remitted and extinguished.

The above remission and extinguishment of entries of outstanding demand shall be carried out in respect of each demand entry falling within monetary limit as specified at para-1 above starting from the earliest assessment year to subsequent assessment year(s), subject to the condition that aggregate value of such demand entries shall not exceed the maximum ceiling of Rs. 1,00,000/- (Rupees one lakh) for any specific taxpayer/ assessee

Further, in order to compute the aforesaid maximum ceiling of Rs. 1,00,000/- (Rupees one lakh), any demand entry having value more than the aforesaid monetary limits as specified in para-1 above shall not be taken into calculation.

Under no circumstance, fraction of any demand entry, whether its value is falling within the monetary limit as specified in para-1 above or not, shall be considered for remission and extinguishment to compute the aforesaid maximum ceiling of Rs. 1,00,000/- (Rupees one lakh).

The aforementioned remission and extinguishment of entries of outstanding demand shall not:-

(i) confer any right to claim credit of any of the remitted and extinguished demand by the taxpayer/assessee under Income-tax Act, 1961 or Wealth-tax Act, 1957 or Gift-tax Act, 1958 or any other law, where such benefit of remission and extinguishment has been allowed to such taxpayer/assessee, or

(ii) confer any right to claim refund of any sum by any taxpayer/assessee under Income-tax Act, 1961 or Wealth-tax Act, 1957 or Gift-tax Act, 1958 or any other law, or

(iii) have any effect on any criminal proceeding/s pending/ initiated or contemplated against the taxpayer/assessee under any Act or law and shall not be construed as conferring any benefit, concession or immunity to the taxpayer/assessee in any such proceedings under any Act or law other than as specifically provided in this order, where such benefit of remission and extinguishment has been allowed to such taxpayer/assessee.

As per the provisions of Rule 19(1) of General Financial Rules, 2017, the above remission and extinguishment of entries of outstanding tax demand under the aforesaid ‘Acts’ shall not have the requirement of audit.

This order shall be implemented by the Directorate of Income-tax (Systems)/ Centralized Processing Centre, Bengaluru (CPC), preferably within two months.

Rectification of any apparent mistake related to the implementation of this order, which may come to the notice shall be carried out by the CPC, Bengaluru and such rectification shall be considered to be the execution of this order.

The Central Board of Direct Taxes (CBDT)/Member (In-charge of Systems and Faceless Scheme), CBDT shall issue directions/ clarifications for any incidental actions required for proper implementation of this order.

The Order can be accessed at: https://www.incometax.gov.in/iec/foportal/sites/default/files/2024-02/Attachment.pdf#

~Navneet Shukla

Leave a comment