Sovereign Gold Bonds (SGBs) are government-issued securities offering a secure and convenient way to invest in gold without physical possession. SGBS provides investors with the opportunity to earn potential capital appreciation due to changes in the price of gold along with a fixed interest. SGBs aim to provide investors with a tax-efficient and hassle-free way to invest in gold as an asset class.

Should you invest?

Advantages:

- Tradable on Exchanges: SGBs can be traded on stock exchanges, offering liquidity and flexibility in investment.

- Tax-free Gains: Profits earned on redemption of SGBs are exempt from capital gains tax.

- Sovereign Guarantee: Backed by the Government of India, providing security and reliability.

- No storage risks or costs: Say goodbye to worries about storing physical gold, as SGBs eliminate the need for physical possession.

- Earn Interest at 2.5% p.a.: Earn a fixed interest rate on your investment payable semi-annually.

- No GST: Unlike physical gold purchases, SGBs don’t incur making charges or GST, making them a cost-effective investment option.

- Can be held in Demat Account: SGBs can be held in electronic form, providing convenience and ease of management.

Tax Treatment:

Capital gains tax exempted on redemption for individuals: This tax benefit on redemption, enhances overall returns. Also exempt from Security Transaction Tax.

Consequences of Early Redemption: Early redemption of SGBs will attract capital gains tax, affecting overall returns. If an investor holds SGBs for more than three years, they can claim the benefit of indexation on Long Term capital gains

Key Features:

- Issue Date: Feb 12 Feb 16

- Issue Price: ₹6,263/gm (₹50/gm discount for online applications)

- Tenure: 8 years with early withdrawal after 5 years, providing flexibility to investors.

- Limits: Individuals/HUFs: 4 kg, Trusts: 20 kg per year, catering to varying investment needs.

- Eligibility: Open to Resident Indians, including individuals, HUFs, Trusts, Universities, and Charitable institutions, ensuring broad accessibility.

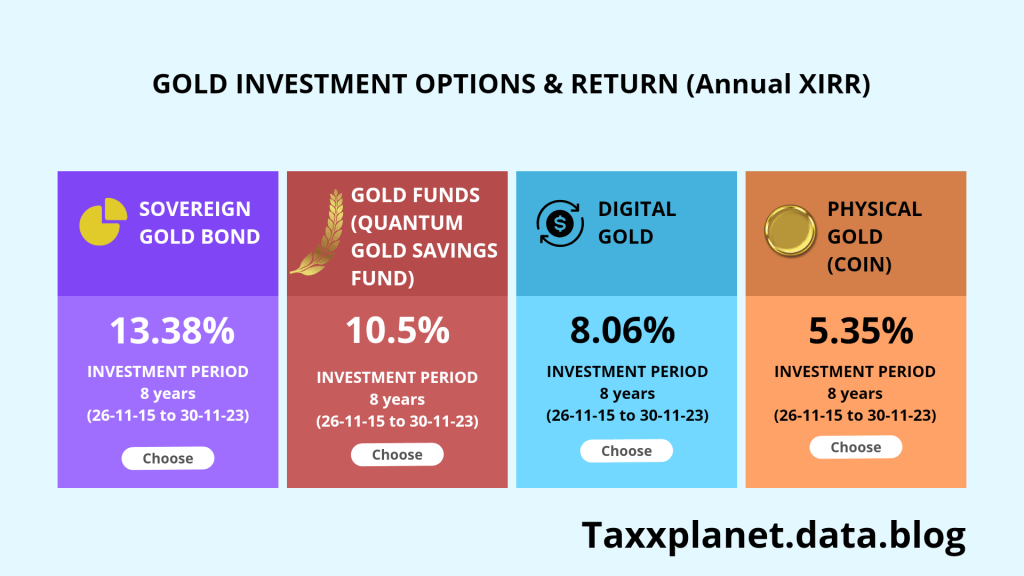

- Performance Insight: SGB 2016-1 matured with an XIRR of over 13%, showcasing its potential for healthy returns and favourable investment performance.

#SovereignGoldBond #SGB #GoldInvestment

~Navneet shukla

Leave a comment