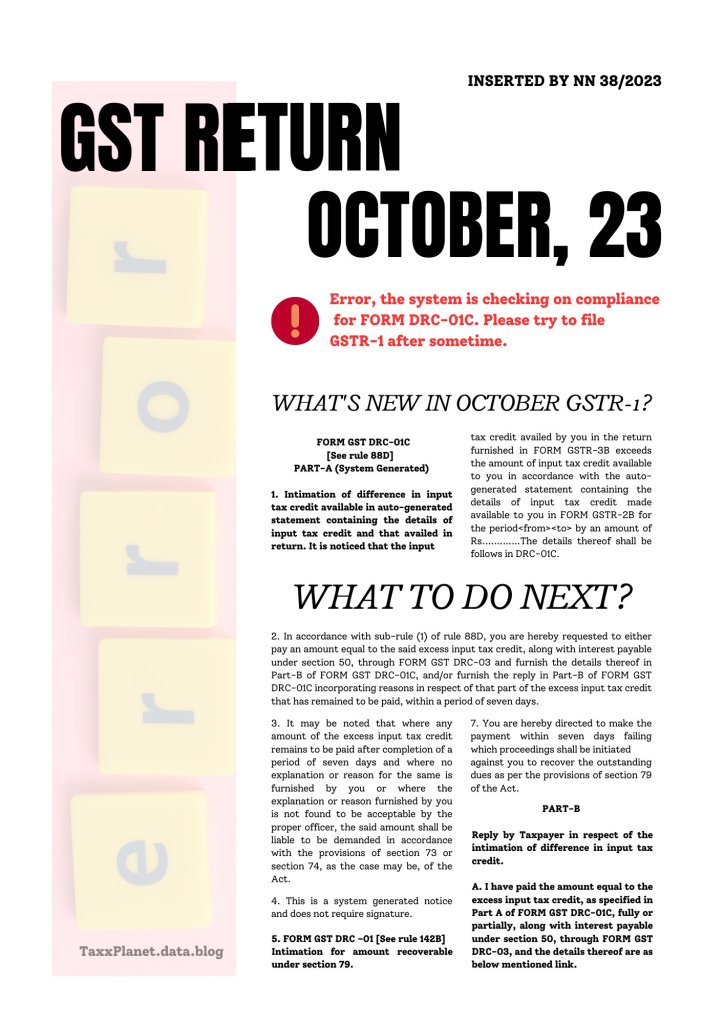

GSTR-1 for October 2023, primarily stemming from the introduction of DRC-01C on October 1, 2023.

Here are three ways for the representative assessee to address these issues:

1) Access the GST portal and navigate to the services section. Check the Tax liability and ITC summary. If there’s a discrepancy and 3B is greater than 2B, the representative assessee should settle the additional ITC using form DRC-03.

2) In cases where the ITC claimed in 3B is less than the auto-populated 2B, the representative assessee should raise a grievance. Include the error details along with the Tax liability and ITC summary, demonstrating that no additional ITC has been claimed in GSTR-3B.

3) The third option for the representative assessee is to exercise patience until October 7, 2023. It’s possible that this issue will be automatically resolved by then.

~Navneet Shukla

Leave a comment