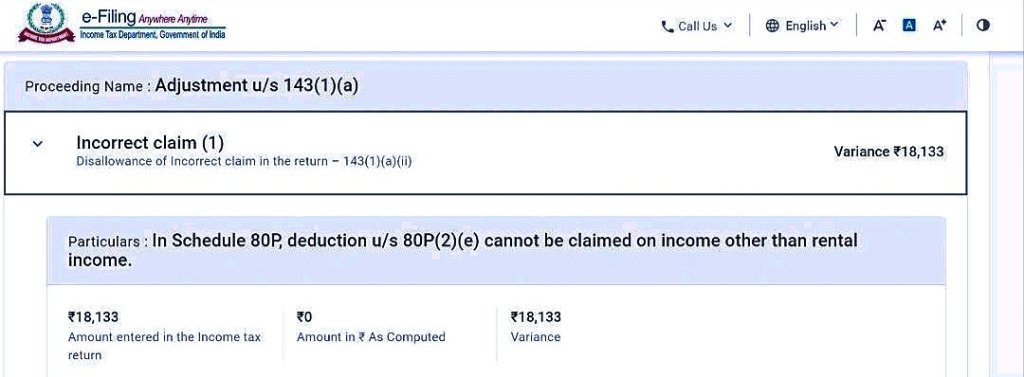

The recent incident involving the CPC (Centralized Processing Center) of Income Tax India Official highlights a concerning oversight in the tax assessment process. This oversight has affected taxpayers nationwide, as many of them have received notices that suggest incorrect adjustments under Section 143(1)(a) of the Income-tax Act.

What’s particularly puzzling about these notices is that they indicate that Section 80P deduction, a provision that allows deductions for cooperative societies, isn’t permissible for the affected taxpayers. However, the issue lies in the fact that many of these taxpayers didn’t even claim such deductions in their Income Tax returns for the Assessment Year 2023-24.

This situation raises several concerns. First and foremost, it points to a significant error or glitch in the processing system or data management at the CPC of Income Tax India Official. Such errors can lead to confusion and distress among taxpayers who are already dealing with the complexities of the tax system.

Furthermore, it underscores the importance of accuracy and transparency in tax assessment processes. Taxpayers rely on the government’s systems to ensure that their tax liabilities are calculated correctly. Mistakes like this can erode trust in the tax system and create unnecessary administrative burdens for both taxpayers and tax authorities.

In response to this situation, it is crucial for the CPC of Income Tax India Official to investigate the root causes of these incorrect notices, rectify the errors, and communicate effectively with the affected taxpayers to resolve the issue promptly. This incident also serves as a reminder of the ongoing need for improvements and modernization in tax administration to minimize such errors in the future.

~Navneet Shukla

Leave a comment