After the conclusion of the Income Tax Returns (ITR) filing period, discussions have arisen on social media regarding the fees charged by Chartered Accountants (CAs). Some individuals assert that these professionals are offering their services at lower rates, while others clarify that the fee structure depends on clients’ circumstances and the complexity of the tasks. However, it’s important to understand the minimum fee set by the Institute of Chartered Accountants of India (ICAI) for ITR filing.

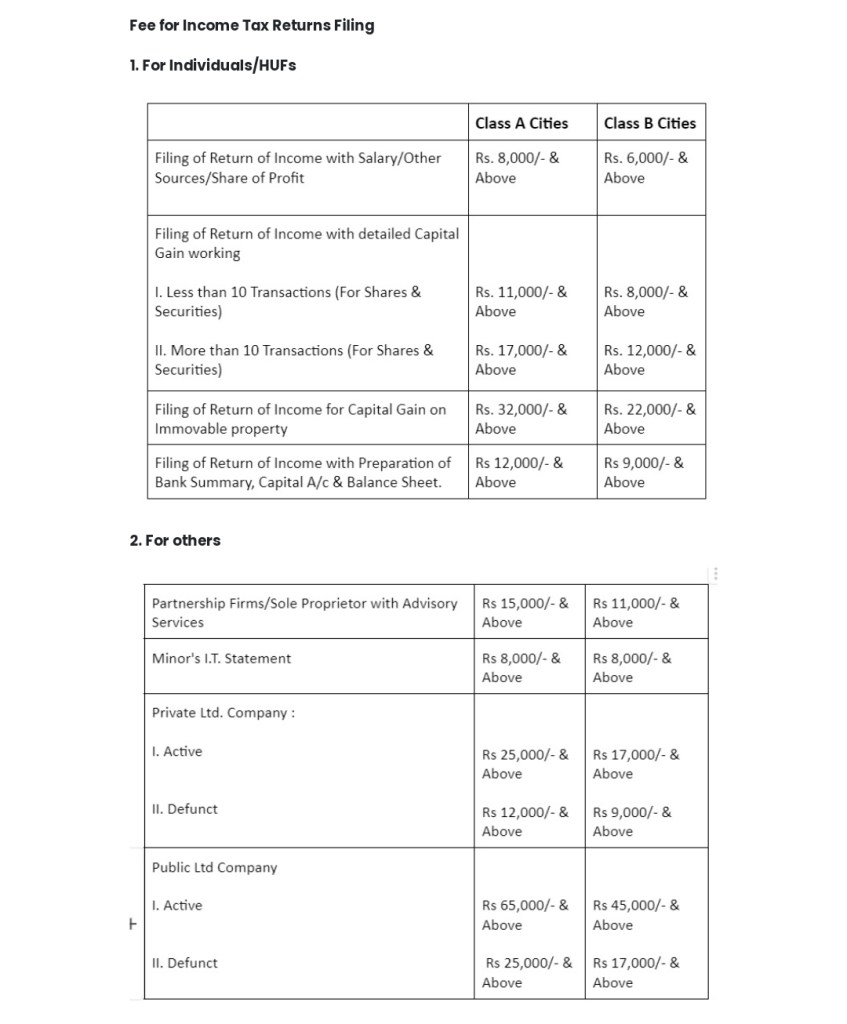

The Committee for Capacity Building of Members in Practice (CCBMP) at ICAI has established the recommended minimum fee scale for professional assignments carried out by CA Institute members. As part of their commitment to bolster Small & Medium Practitioners, the CCBMP at ICAI has introduced a Revised Minimum Recommended Scale of Fees for professional assignments performed by their members. The committee has proposed distinct minimum fees for ITR filing in Class A Cities and Class B cities.”

The aforementioned charges are established to bolster Small & Medium Practitioners. Professionals also have the flexibility to impose fees exceeding this rate based on their expertise, client base, and the extent of tasks to be undertaken.

~Navneet Shukla

Leave a comment