The Central Board of Direct Taxes(CBDT) has notified 3 new special courts for Black Money and Income Tax Provisions via issuing Notification.

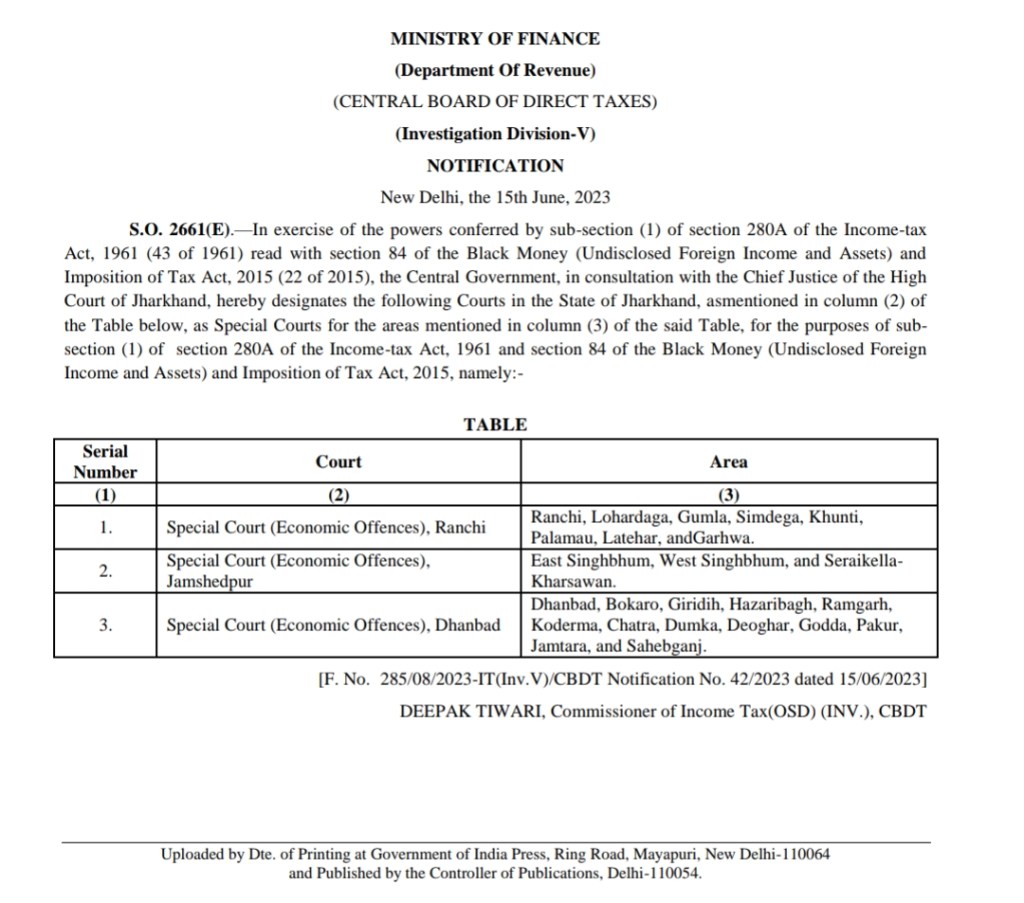

The Central Board of Direct Taxes (CBDT) has issued a notification announcing the establishment of three new special courts to handle cases related to black money and income tax provisions. The notification states that the creation of these courts is done in accordance with the powers conferred by sub-section (1) of section 280A of the Income-tax Act, 1961 (43 of 1961), read with section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (22 of 2015).

The Central Government, in consultation with the Chief Justice of the High Court of Jharkhand, has designated specific courts in the state of Jharkhand as special courts. These courts are listed in column (2) of the table mentioned in the notification. They have been designated as special courts for the areas specified in column (3) of the table. The purpose of establishing these special courts is to handle cases falling under subsection (1) of section 280A of the Income-tax Act, 1961, and section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

Navneet Shukla

Leave a comment