A total of 23 Registered Unrecognized Political Parties, 35 bogus intermediary entities and 3 major exit providers were jointly called as RUPP group of Ahmedabad.

A search operation on RUPPs revealed that the donation is received by RUPPs through the cheque/RTGS/NEFT in the RUPP’s bank account .This money is then re-routed through various layers, and returned to the original donors, primarily in the form of cash, in lieu of some commission that ranges from 3.5% to 5%. It is pertinent to mention here that the political party doesn’t pay any tax since it exempt us 13A of the Act. Further, the donors claim deduction u/s 80GGB/80GGC of the Income Tax Act, 1961. Thereby, the income earned by the donors is escaped from the tax in the name of political donations.

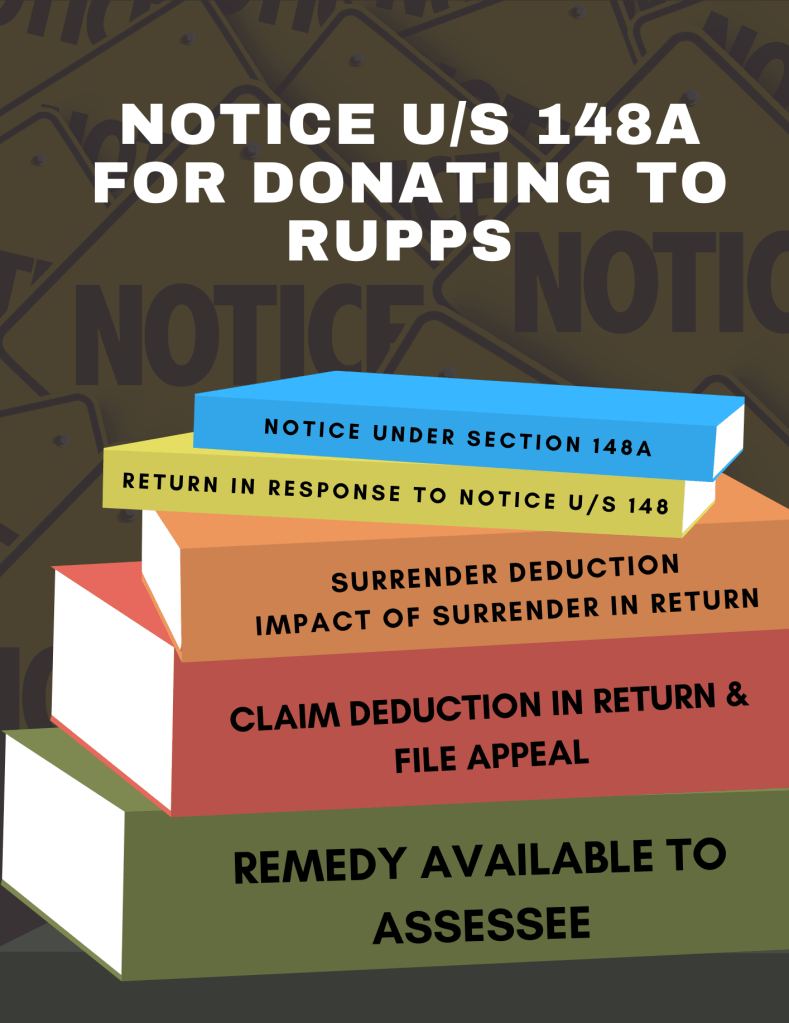

As per information, assessee who has obtained an accommodation entry in the form of Political donation of certain amount during FY 2018-19 relevant to AY 2019-20 and Further, on going through the return of income filed by Assessee for AY 2019-20, it is noticed that Assessee have claimed a donation of that certain amount u/s 8OGGC of the Act. Thus, the donation shown to the above mentioned Political Parties(i.e. RUPPs) by Assessee is bogus and the claim of deduction u/s 80GGC of the Act on the basis of such bogus donation is not allowable.

-Navneet Shukla

Leave a comment